Calendar Option Strategy – On the other hand, due to high volatility, risk is also high. So we have created this Nifty Options Strategy for Election Result Week (Calendar spread) to limit our risk. Before deploying this . As we continue to maneuver the second half of the calendar year, now is the perfect time for investors to refresh on important options strategies. One notable strategy worth focusing on is the .

Calendar Option Strategy

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

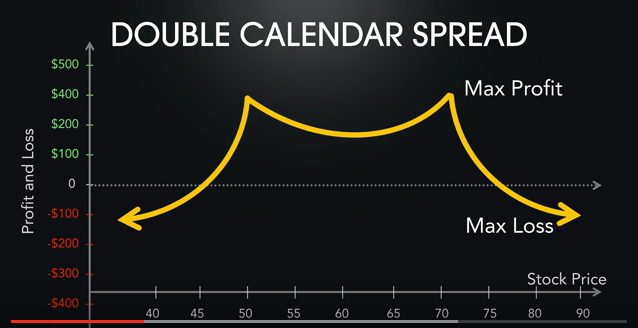

The Double Calendar Spread

Source : www.options-trading-mastery.com

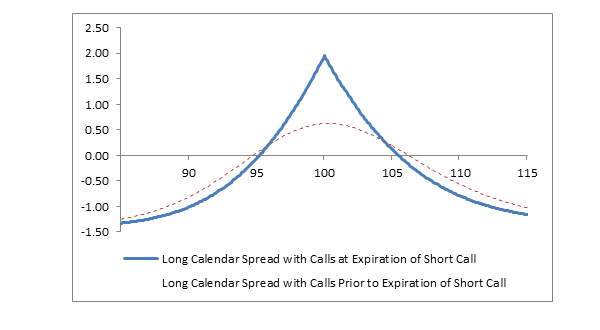

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

Option expiry trading strategy (Double calendar spread) | no

Source : www.youtube.com

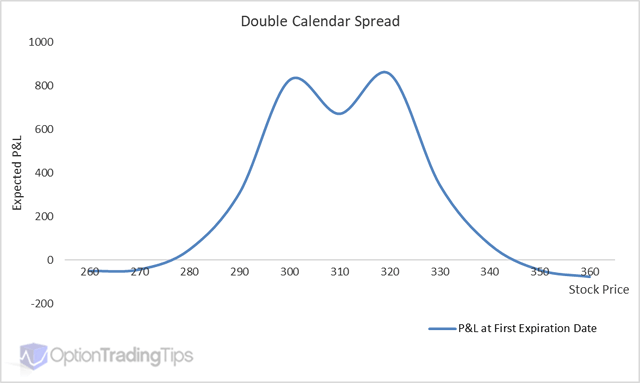

Double Calendar Option Spread

Source : www.optiontradingtips.com

Long Calendar Spreads Unofficed

Source : unofficed.com

Calendar Spread Options Trading Strategy In Python

Source : blog.quantinsti.com

Calendar Delta is a neutral option trading strategy that involves

Source : medium.com

Calendar Spread Options Strategy | Steady Options

Source : steadyoptions.com

Calendar Option Strategy Calendar Spreads in Futures and Options Trading Explained: However, implied volatility is only one piece of the puzzle when putting together an options trading strategy. Clearly, options traders are pricing in a big move for Coursera shares, but what is the . We have the answer for Calendar viewing option crossword clue last seen on June 4, 2024 if you need some assistance in solving the puzzle you’re working on. The combination of mental stimulation, .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)